HiddenWorldofData.com will help people better understand and manage their digital world to protect personal data just like other asset protection plans.

Protecting the things you love is Allstate’s mission, and in this hyper-connected digital world, personal data security protection is more important than ever. Now, the nation’s largest publicly held personal lines insurer, is helping consumers decide for themselves how they want their data shared and used to help manage their personal data, or digital footprint.

Allstate found that the public’s understanding of this complex topic is murky – and Allstate wants to help by making everything as transparent as possible. New research conducted by Allstate via an Allstate Digital Safety Survey found 95 percent of respondents reported that protecting their personal information online is important, similar to protecting their identity or home/property.

“As data sharing becomes a part of everyday life in today’s increasingly digital world, when managed appropriately, it can be incredibly helpful to consumers,” said Nicolette de Guia, Head of Consumer Innovation and Design at Allstate. “Data sharing provides us with many benefits and conveniences – from using apps to avoid traffic and uploading photos to stay in touch with friends. Allstate wants consumers to continue enjoying these benefits of data sharing while ensuring they’re doing it in a smart and safe way for themselves and their family. »

HiddenWorldOfData.com: Data Privacy and Security Education Hub

Allstate is aiming to educate consumers on how to protect themselves and their families online against today’s common data privacy and security concerns, including social sharing, location services and online shopping and banking. HiddenWorldOfData.com is an online hub for information about controlling your digital footprint, the impact of sharing on social media, location services, online shopping, phishing and so much more. It’s a one-stop-shop to help you manage your digital footprint safely in today’s online world.

Allstate Research Findings

To unveil new research findings on data privacy and security, Allstate is working with American journalist and tech expert, Katie Linendoll, who will share the survey results for the first time at Collision Conference, one of the fastest growing tech conferences in the world, in New Orleans on May 2.

According to the Allstate Digital Safety Survey:

- Only about half of Americans understand that activities like downloading an app or uploading photos to social media contribute to their digital footprint. Though the average person has about 150 online accounts, 87 percent of our survey respondents either thought they had under 50 or had no idea.

- Despite being knowledgeable on personal data protection, half of Americans have had their personal information compromised online with 37 percent having unauthorized charges on their bank statement.

- While 85 percent of respondents are uncomfortable providing their social security information online, nearly half (46 percent) have provided this information online in the past.

- Those who are younger are at a higher risk of having their information stolen as they tend to be less informed, riskier with the information they share online and take less steps to protect themselves (YouGov on behalf of Allstate, March 23, 2018).

“I talk to a lot of people about our digital world and it’s surprising how many don’t protect their online data like they would for any other important personal asset like your home, car and finances,” said Katie Linendoll, technology expert. “I’m excited to work with Allstate to help educate people on utilizing the convenience data sharing offers us while protecting their online identity. »

ALLSTATE RESEARCH

Americans are highly knowledgeable on personal data protection and think of it as an important asset to protect, like their home.

- Four in five say they are knowledgeable on the topic of personal data protection (80%), data privacy (79%) and data security (79%).

- Nearly all (92%) respondents feel protecting their personal information online is important; just as important as protecting their identity (93%) or home/property (90%).

- Half of Americans (51%) would rather spend the day without their phone than have their personal information compromised online, and 41% would rather show an embarrassing childhood photo to coworkers.

Despite this, half of Americans have had their personal information compromised online (47%).

- Of those affected by online compromises, 37% had unauthorized charges on their bank statement and 21% had to delete their account(s).

- Three in five of those who have had these incidents occur say it made them feel angry (59%), and two in five say they also felt vulnerable (42%).

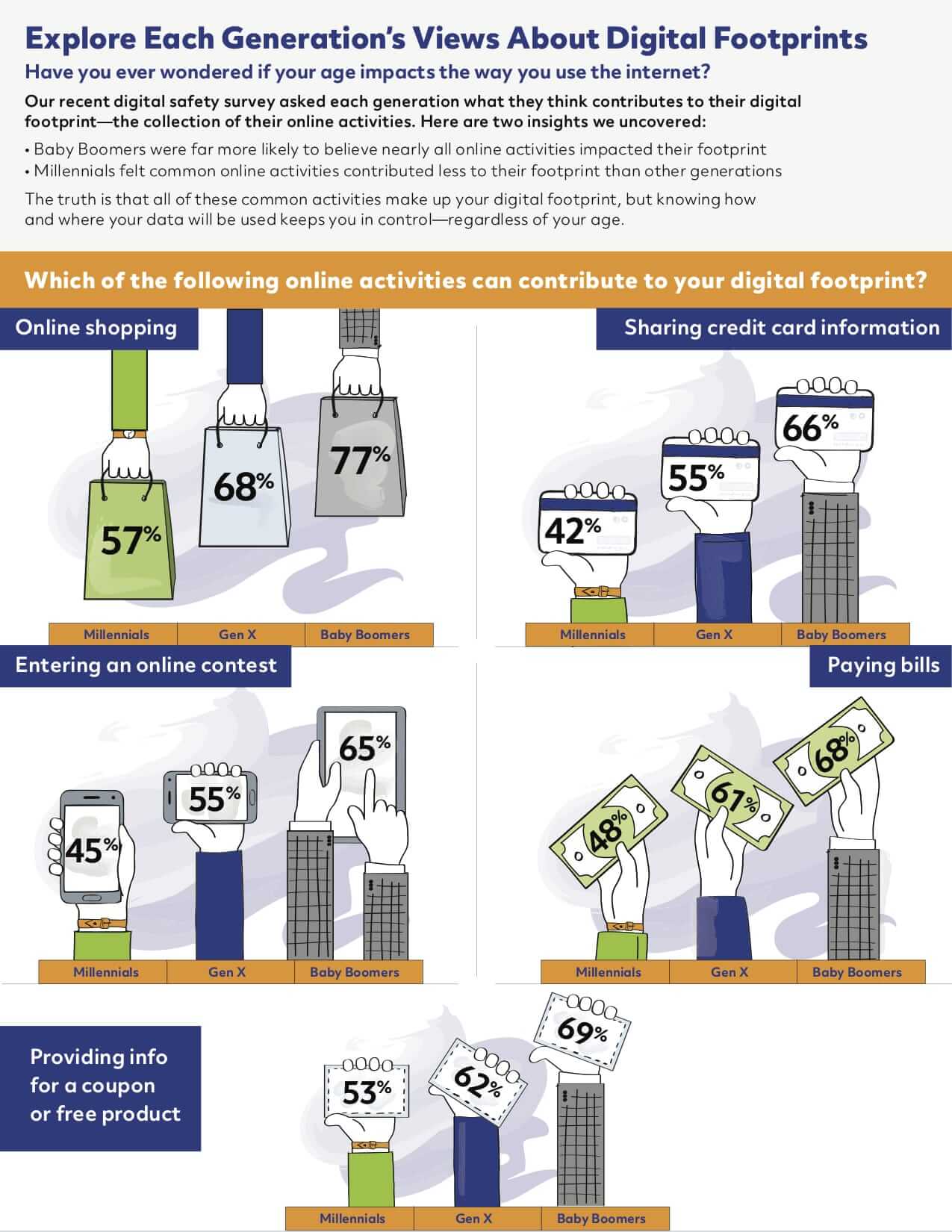

Many Americans are not familiar with the concept of a digital footprint and are unaware the information they share online contributes to it.

- One-third (35%) of respondents have never heard of a digital footprint or only know the name and just 8% claim to know a lot about their own digital footprint.

- Only about half of Americans believe common online activities contribute to their digital footprint, despite seven in ten (70%) claiming to have between one and twenty active online accounts:

- Uploading photos to social media (56%)

- App downloads (56%)

- Sharing credit card information online (55%)

- Sharing articles or statuses to social media (55%)

- Entering a contest online (55%)

- Connecting to free Wi-Fi hotspots (52%)

- Additionally, 39% of respondents say they get emails from websites they haven’t used in years.

But, many are taking steps to protect themselves online, both proactively and after a compromise of information.

- Americans are currently taking actions to protect themselves online, such as:

- Not posting about upcoming vacations on social media (51%).

- Never automatically saving payment or credit card info (38%).

- Not allowing websites or apps to know their location (35%).

- Almost all (93%) of those who have had their personal information compromised took some form of action following the incident:

- Three in five changed their password (58%).

- Two in five reported the incident to the affected website (42%).

- One-third notified friends and family (33%).

- One-third researched how to prevent it from happening in the future (32%).

Everyday life requires us to share more information online than ever, which leads to both increased convenience and the need for increased safety and online education.

- Over one-third (35%) of respondents say they share more information online now than they did five years ago.

- While 85% of respondents are uncomfortable providing their social security information online, nearly half (46%) have provided this information online in the past.

- Two in five (43%) agree that mobile baking and payment apps save them time, while 29% agree that automatically storing their information on websites and apps makes their life easier.

Those who are younger are at a higher risk of having their information stolen as they tend to be less informed, riskier with the information they share online and take less steps to protect themselves.

- One in four respondents 18-34 say they’ve never heard of a digital footprint, compared to 15% of those 35-54 and 55+. Those 18-34 are also more likely to say they’ve never heard of data security (13%) and personal data protection (13%).

- Those who are 18-34 are more comfortable than those 35-54 and 55+ with sharing information online such as their birth date (64% vs. 49% vs. 39%), location (45% vs. 41% vs. 37%) and social security number (24% vs. 16% vs. 6%).

- Three in five respondents 18-34 say they’ve shared their social security number online (57%) compared to half of those 35-54 (51%) and one in three of those 55+ (33%).

- Those who are 55+ are more likely than those 18-34 and 35-54 to have taken actions to protect themselves online:

- Never automatically save payment or credit card info (51% vs. 32% vs. 30%).

- Never provide their mobile or home phone number online (30% vs. 19% vs. 21%).

- Do not allow websites or apps to know their current location (42% vs. 27% vs. 34%).

- Do not post about upcoming vacations on social media (71% vs. 32% vs. 46%).

For more information, visit www.HiddenWorldofData.com.